Investing in a Telecommunication Company for Sale: A Comprehensive Guide

The telecommunications industry is one of the fastest-growing sectors globally, driven by the rise of digital technology and enhanced connectivity. With an increasing demand for communication services, investing in a telecommunication company for sale can be a lucrative opportunity for business-minded individuals and investors. This article delves into the intricacies of acquiring a telecom company and how it can redefine your investment portfolio.

Understanding the Telecommunications Sector

The telecommunications sector encompasses a broad range of services, including telephone services, internet connections, and television broadcasting. As an essential part of modern infrastructure, the demand for robust telecom services continues to grow, providing opportunities for new and established companies alike. Some key components of the telecommunications industry include:

- Wireless Communications - This includes mobile networks, cellular services, and other wireless technologies.

- Broadband Services - Internet service provision via DSL, fiber, and cable systems.

- Television Services - Satellite and cable television services.

- VoIP Services - Voice over Internet Protocol offerings for clear and cost-efficient calling.

The Appeal of Buying a Telecommunication Company

Purchasing a telecommunication company for sale presents numerous advantages that can significantly enhance your investment strategy:

1. Growing Demand

As more people leverage the internet and mobile services for daily communication, the demand for telecommunication services continues to expand. This growth trajectory signals strong revenue potential for businesses in this sector.

2. Technological Advancements

Innovations such as 5G technology, the Internet of Things (IoT), and cloud computing demand robust telecommunications solutions. Companies involved in these sectors are positioned to benefit from such advancements, driving their value upwards.

3. Diversified Service Offerings

Telecommunications companies often provide a variety of services, allowing for multiple streams of revenue. This diversification helps mitigate risks and provides stability during economic downturns.

4. Potential for Expansion

Many telecom companies possess the infrastructure to expand and include new services or reach new geographical areas. By investing in such companies, you can capitalize on this growth potential.

Key Considerations Before Purchasing a Telecommunication Company

While the benefits of acquiring a telecommunication company for sale are evident, there are critical factors to consider to make an informed decision:

1. Market Analysis

Understanding the market landscape is crucial. Conduct a thorough market analysis to identify competitors, market trends, and consumer demand. Analyzing these factors will help assess the company's current position and future potential.

2. Financial Health

Scrutinize the financial statements of the business. Assess key metrics such as revenue growth, profit margins, and debt levels. A financially sound company is more likely to yield a successful investment.

3. Regulatory Compliance

Telecommunications is a heavily regulated industry. Ensure the company is compliant with all local, national, and international regulations. Non-compliance can lead to significant financial penalties and damage to reputation.

4. Customer Base

Analyze the company’s customer base. A loyal and growing customer base indicates business viability. Consider customer satisfaction ratings, retention rates, and churn ratios, as these factors significantly impact long-term success.

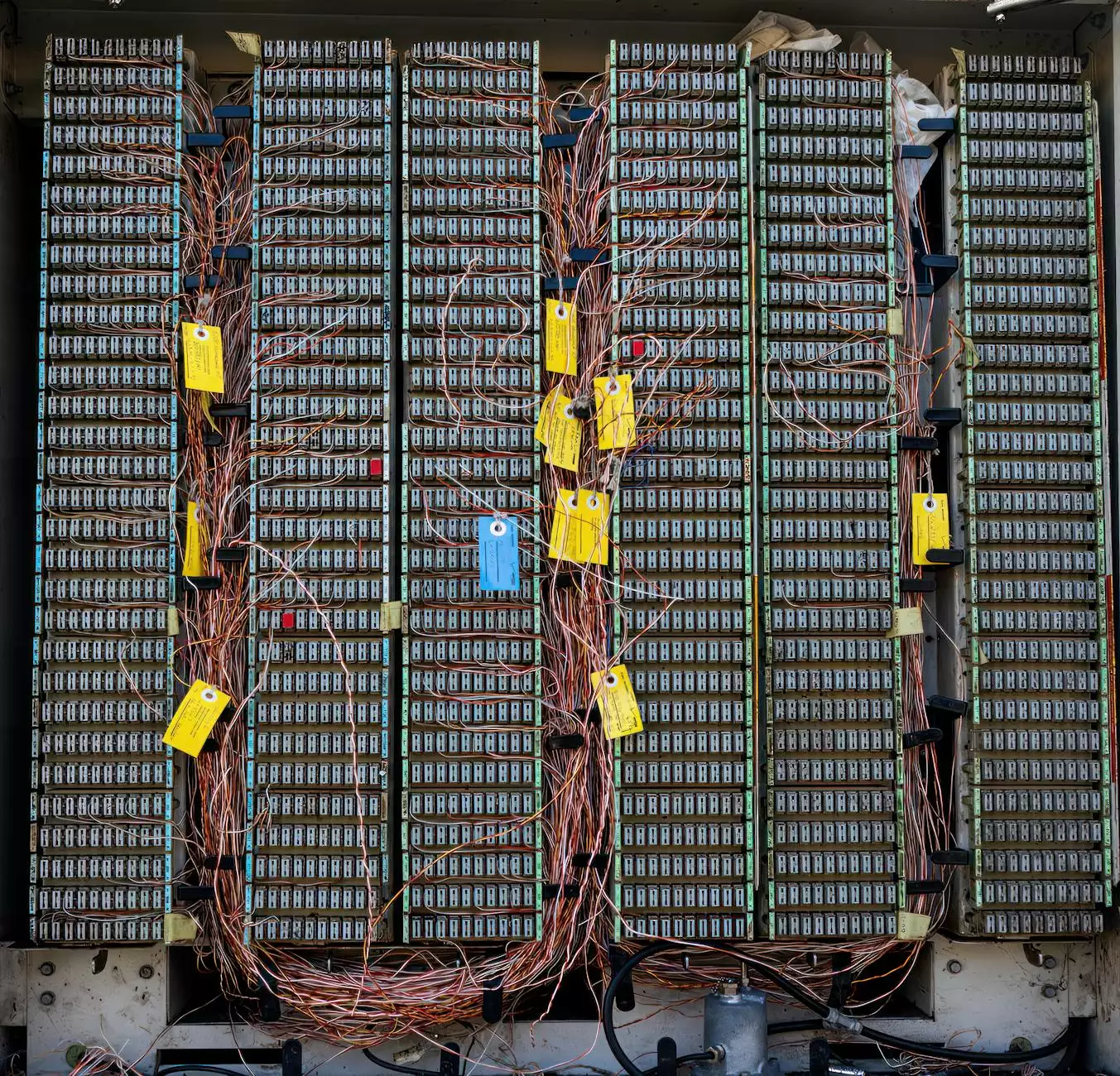

5. Technology and Infrastructure

Evaluate the company's technology and infrastructure. Is it up-to-date and capable of supporting future growth? Investing in a company with outdated technology could hinder its performance and limit growth opportunities.

Steps to Acquire a Telecommunication Company

If you've decided to move forward with acquiring a telecommunication company for sale, follow these essential steps:

1. Define Your Investment Criteria

Establish clear investment criteria that align with your financial goals and risk tolerance. Consider factors such as the desired size of the telecom company, geographical location, and service offerings.

2. Conduct Due Diligence

Thoroughly investigate the telecom company of interest. Due diligence should include a review of financial records, operational processes, legal compliance, and market positioning to uncover potential issues before making an offer.

3. Secure Funding

Identify how you will finance the acquisition. Options may include personal funds, loans, or investment partnerships. Ensure that your funding strategy aligns with the scale of the acquisition.

4. Make an Offer

Once you are comfortable with your findings from due diligence, prepare a formal offer. This document should outline the purchase price, payment terms, and any contingencies related to the business acquisition.

5. Close the Deal

After negotiations and agreement on the terms, finalize the transaction and complete all legal documentation necessary. Work with legal and financial professionals to ensure compliance and protection during the process.

Post-Acquisition Strategies for Growth

After acquiring a telecommunication company for sale, developing a clear growth strategy is essential to maximize your investment. Here are some effective strategies:

1. Focus on Customer Service

Enhancing customer service should be a primary focus. Providing excellent service can improve customer satisfaction, leading to higher retention rates and word-of-mouth referrals.

2. Invest in Technology

Stay abreast of technological developments and invest in cutting-edge technologies that can improve operational efficiency and service delivery. Consider implementing AI and machine learning for enhanced customer interaction and efficiency.

3. Explore New Markets

Look for opportunities to expand into new markets, both geographically and through new service offerings. Conduct market research to identify potential areas for growth.

4. Build Strategic Partnerships

Collaborating with other businesses can offer significant benefits. Consider partnerships that can enhance service offerings, improve customer acquisition, or expand operational capabilities.

5. Regularly Assess Performance

Implement a system for regularly assessing the performance of your telecom company. Use key performance indicators (KPIs) to gauge growth and implementation of strategic initiatives.

Conclusion

Investing in a telecommunication company for sale presents a unique opportunity in one of the most vital and expanding industries. Through careful consideration of the market landscape, financial health, and growth strategies, investors can unlock substantial potential and set themselves up for long-term success. By following the guidelines laid out in this comprehensive guide, you will be well-prepared to embark on your journey into the telecommunications realm.

As you contemplate this strategic investment, remember to stay informed and adaptable to the continuously evolving technology landscape, ensuring your telecom venture not only thrives but also leads the market.